Foxsea

Well-Known Member

I'm not sure where your information came from:$2.00 is going to be cheap. My bet is within 2 years it will be closer to $4.00. The way the governments are forcing this green movement on us and companies all that money will be transferred over to the customer. Carbon taxes of $170/ $200 tonne are coming. Fuel taxes and transportation costs are going to go through the roof and again no one but the small guy will pay for this. Many are predicting $120/bbl oil here soon. Just look at inflation over the last 6 months to a year and that is peanuts to what’s coming. Bank of Canada is eyeing up multiple rate hikes over the next few months. Buckle up kids,, it’s going to get tough. Excess capital is going to get thin for many.

Oh well,, they are getting what they voted for hard to feel sorry for people.

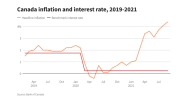

"A majority of economist surveyed expects the Bank of Canada (BoC) will keep its ‘Target Rate’ at the ‘effective lower bound’ of 0.25% until mid-2022.

The Bank of Canada says it will keep variable interest rates low until the economy has recovered and inflation has reached roughly 2 percent. Inflation is currently running above 4% because of supply chain disruptions. The expectation of prolonged lower interest rates shows the economy is unlikely to recover fully until late 2022.

In this area the very few homes for sale often have multiple offers and sell for $100,000 over asking, well > $1,000,000 cash, no conditions. These enthusiastic buyers have no concerns with mortgage rates.

As for oil prices:

Earlier this week, Fitch Solutions Country Risk & Industry Research released its latest oil price forecasts to 2025. These projected that Brent crude prices will average $70 per barrel in 2021, $67 per barrel in 2022, $68 per barrel in 2023, $70 per barrel in 2024 and $73 per barrel in 2025. The Bloomberg Consensus forecasts that Brent crude prices will average $69 per barrel this year, $66.5 per barrel next year, $66 per barrel in 2023, $70 per barrel in 2024 and $65.7 per barrel in 2025. OPEC is expected to continue to maintain this tight trading range.

You are making things up in an alarmist's style. Is the sky falling ... again?

Last edited: