You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Hot stock tips

- Thread starter Rain City

- Start date

ab1752

Crew Member

Shorts must be getting murdered. Pretty remarkable run, who cares about fundamentals anymore. If you're bored check out the SONA board on ceo.ca and read through the bs as it went from a buck to 16 and back again.

I think AI plays will be strong in 2021, stuff like vsby and such. Big bro stuff.

I think AI plays will be strong in 2021, stuff like vsby and such. Big bro stuff.

Rain City

Crew Member

I cashed out a lot on Friday to let things cool off. I only play with 10% of what we have the rest is with a guy so I don't gamble it away on things like this lol.Shorts must be getting murdered. Pretty remarkable run, who cares about fundamentals anymore. If you're bored check out the SONA board on ceo.ca and read through the bs as it went from a buck to 16 and back again.

I think AI plays will be strong in 2021, stuff like vsby and such. Big bro stuff.

ab1752

Crew Member

Lots of bag holders on sona, gotta love the cse until you're one of em.

I'm holding J&J long, stock is moving well as they a) beat the street with reporting today and b) will report their phase vaccine 3 data soon. If they can make it with their one shot, that's huge for getting vaccines rolled out with scale.

I'm holding J&J long, stock is moving well as they a) beat the street with reporting today and b) will report their phase vaccine 3 data soon. If they can make it with their one shot, that's huge for getting vaccines rolled out with scale.

wildmanyeah

Crew Member

I'm actually fascinated that social media coordinated enough to squeeze institutional investors.

www.polygon.com

www.polygon.com

GameStop stock price still hitting records as Redditors squeeze short sellers

Bubble expected to burst, but not before Redditors hand investors their heads

www.polygon.com

www.polygon.com

ReelSlim

Crew Member

Lots of bag holders on sona, gotta love the cse until you're one of em.

I'm holding J&J long, stock is moving well as they a) beat the street with reporting today and b) will report their phase vaccine 3 data soon. If they can make it with their one shot, that's huge for getting vaccines rolled out with scale.

I was lucky and rode it into the 15’s. I jumped back in when I thought it was done falling around 8 and lost a bit but overall a success. Not going to lie but it covered the difference between the old cabin and the new one. It’s unfortunate what happened to them as I thought it was a great technology. However it seems like the 10 baggers are all companies with an idea only and no revenue. I’m sure if you are an old school investor it’s like freaky Friday everyday....for now? Lol

I'm actually fascinated that social media coordinated enough to squeeze institutional investors.

GameStop stock price still hitting records as Redditors squeeze short sellers

Bubble expected to burst, but not before Redditors hand investors their headswww.polygon.com

Yah, I don't feel bad for them. Apparently, one of the main hedgefunds that is super short the founder worked with Stephen Cohen. That guy was fined big for market manipulation previously and I believe went to jail.

Rain City

Crew Member

It's a great storyI'm actually fascinated that social media coordinated enough to squeeze institutional investors.

GameStop stock price still hitting records as Redditors squeeze short sellers

Bubble expected to burst, but not before Redditors hand investors their headswww.polygon.com

wildmanyeah

Crew Member

I can't put a dime in the CSE. I get people make money, but way too many grifters. Have a look at all the cash swap consulting fee crap that was going on the last few years. Just disgusting in my opinion.

I really can't avoid the stock market if i want my retirement portfolio to beat inflation.

cracked_ribs

Well-Known Member

This one I watched from the sidelines; very busy the last few days.

But I love those volatile surges, I just set limits and try to get in and out really fast. I did this on BNGO most recently...in @4.80, out 14 minutes later at 5.75. it was pinging around all over the place for about an hour so I just set the buy on the very low end, and the sell about 3/4s of what the peaks I was seeing looked like. Quick bang bang play, out with a mortgage payment. I don't do it all the time, but when I see a lot of hype and volatility on a given stock, I'll usually look to exploit it.

But I love those volatile surges, I just set limits and try to get in and out really fast. I did this on BNGO most recently...in @4.80, out 14 minutes later at 5.75. it was pinging around all over the place for about an hour so I just set the buy on the very low end, and the sell about 3/4s of what the peaks I was seeing looked like. Quick bang bang play, out with a mortgage payment. I don't do it all the time, but when I see a lot of hype and volatility on a given stock, I'll usually look to exploit it.

Rain City

Crew Member

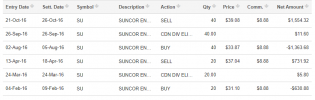

It's hard not to do it. I just picked up more Suncor and now I'll ride this out for a while. Cash cash cash.This one I watched from the sidelines; very busy the last few days.

But I love those volatile surges, I just set limits and try to get in and out really fast. I did this on BNGO most recently...in @4.80, out 14 minutes later at 5.75. it was pinging around all over the place for about an hour so I just set the buy on the very low end, and the sell about 3/4s of what the peaks I was seeing looked like. Quick bang bang play, out with a mortgage payment. I don't do it all the time, but when I see a lot of hype and volatility on a given stock, I'll usually look to exploit it.

I really can't avoid the stock market if i want my retirement portfolio to beat inflation.

Yah, but there are other stocks with growth that are not on the CSE. TSX-V is better, TSE has decent growth stuff too. CSE to me is more of lotto.

wildmanyeah

Crew Member

ab1752

Crew Member

I was lucky and rode it into the 15’s. I jumped back in when I thought it was done falling around 8 and lost a bit but overall a success. Not going to lie but it covered the difference between the old cabin and the new one. It’s unfortunate what happened to them as I thought it was a great technology. However it seems like the 10 baggers are all companies with an idea only and no revenue. I’m sure if you are an old school investor it’s like freaky Friday everyday....for now? Lol

That's fantastic to have a win like that, and I think the memory books won't be kind to sona. The class action parade has begun and I know more than a few guys with six figure positions at 10 bucks acb, these guys have handle it but man, i'm good thanks.

If these markets hold up through the next 90 days when the shots roll out, then it will be an interesting year across the board. Many are calling it the 9th inning and time to move to cash, but who cares about retail, it is still the institutional investors calling the shots.

ReelSlim

Crew Member

It's hard not to do it. I just picked up more Suncor and now I'll ride this out for a while. Cash cash cash.

I keep some money to play with after a great Covid trading run. I have a decent play in Suncor as well. Just put it in the shelf for the next few quarters and it’s an easy 30-50% upswing. Kind of boring after the last year but gotta play it safe I think with some crazy times still to come. I have CNQ as well with a bigger dividend. Mostly sitting on stock since it’s part of my compensation at work but SU has more room to run this year.....imo We have been smashing production and at record low costs. Don’t believe everything in the news these days. No shortage of buyers for Canadian oil. Good Luck! Lol

Similar threads

- Replies

- 0

- Views

- 332