You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Hot stock tips

- Thread starter Rain City

- Start date

nicnat

Well-Known Member

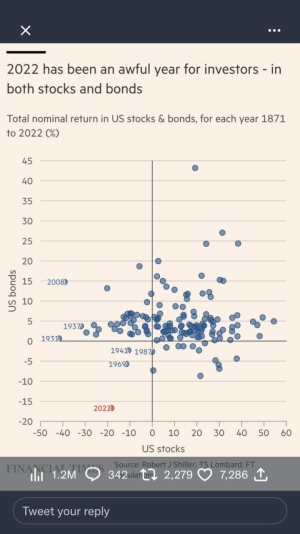

anyone doing any xmas shopping for stocks thru the end of tax loss selling, some of these small caps are pretty tempting, lots of quality blue chips pretty reasonably priced too. I've been establishing a fixed portion lately, which I haven't really had since 2009 once the low interest rate environment started, it's been pretty much 100% stocks since then with lots of blue chip utility types with good divies, I've always kinda considered my company pension as a giant bond, I went mostly to cash last spring knowing int rates were going up, so now I've been buying a mix of growth and divy stocks slowly adding bit by bit on dips etc so up to mostly 1/2 positions, some a little more some less, but I've decided at least a 30% fixed income part is well worth it now for me being retired for a while now, so I've added laddered gic's and individual corp bonds, I'll never bought a bond fund or etf and never will, way to easy to lose money. still have to add a few more corp bonds as I think you may be able to eke out a bit higher rate, maybe, but not for long it looks like. not much chatter on here but it's a great opportunity for the do it yourself people to high grade portfolios, add some fixed income and maybe some cheap well established smallcraps, just stay away from anything with too much debt, none is even better which is what I'm looking for. been in energy for a while great gains and now trade it, probably time to add a bit there especially if china opens up. cheers and happy holidays nicnat.

ab1752

Crew Member

I am watching venture short reports and for issuers where the shorts are in rapid decline, there's an indicator for me to do some due diligence. Those who shorted the vventure this year I applaud, the math made sense almost across the board. But these folks aren't dummies and when they either pull the short or its called and they don't step back on, you'll see volumes pick up for the right plays and that's a key sign for me anyway, time to step in.

alumaman

Well-Known Member

We were down about 3% from our initial investment with our broker until they wrote down an investment late august that went into receivership and had thier funds frozen in April of 2021. We met with her and talked numerous times last year and not one mention of revievership or frozen funds. I checked the account balance regularly and this particular fund looked fine and was holding steady so why look into it or investigate. In late August she sent me a letter that "just came across her desk" after I called and asked about the drop in our account. I assumed from the way she was talking it just happened. After googling the outfit in recievership and seeing how much of a tangled web it was we fired her and are in the process of finding another place to put our money and it's going to be one of the big banks. The saving grace is GIC rates are increasing so I'm going this route until things settle down. Once we recieve all our money I'm going to look into legal action.

alumaman

Well-Known Member

We were down about 3% from our initial investment with our broker until they wrote down an investment late august that went into receivership and had thier funds frozen in April of 2021. We met with her and talked numerous times last year and not one mention of revievership or frozen funds. I checked the account balance regularly and this particular fund looked fine and was holding steady so why look into it or investigate. In late August she sent me a letter that "just came across her desk" after I called and asked about the drop in our account. I assumed from the way she was talking it just happened. After googling the outfit in recievership and seeing how much of a tangled web it was we fired her and are in the process of finding another place to put our money and it's going to be one of the big banks. The saving grace is GIC rates are increasing so I'm going this route until things settle down. Once we recieve all our money I'm going to look into legal action.

I got burned from the same firm i lost over 30000 with rockridge

SpringFever552

Well-Known Member

Rain City

Crew Member

Haha I sent that to a bunch of buddies last week only I was talking about a pod and two new outboards lol

ship happens

Well-Known Member

That's because you can't handle a boat and your not a fisherman, your a little spec who wants to make money and expect things to appear. Good luck on that one

wishiniwasfishin1

Well-Known Member

Sooo… the market has ripped since the last post. Anyone make any money on some of the faang or tsla? I’m sure some of you guys jumped in. My meta is up 55%. Won’t mention the ones that went the other way though  . Msft doing well too. Recently went a little heavy on oil stocks RIG and oxy and slb.

. Msft doing well too. Recently went a little heavy on oil stocks RIG and oxy and slb.

You guys finding any gems?

You guys finding any gems?

sasqman

Crew Member

Fed Official Warns U.S. Debt Default Would Be ‘Catastrophe’ As Bank Of America Gears Up For The Worst

“There is a temptation to brush off the developing debt limit drama. . . . That would be a mistake,” one economist warns.

www.forbes.com

www.forbes.com

wishiniwasfishin1

Well-Known Member

Yeah same re plug. Down a bit but also long fcel. The powers that be will push pretty hard for renewables so should do well.I have been watching PLUG and stepped in at 14, it's going to sit on my long side. I also am watching Google now that bard put a fork in the sp and started a position for the first time today.

N2013

Well-Known Member

I’m up 6.15% so far YTD. But in the grand scheme of things, it means nothing. Keep buying VEQT whenever I can. Don’t need to hit home runs, I’ll take singles all day long.Sooo… the market has ripped since the last post. Anyone make any money on some of the faang or tsla? I’m sure some of you guys jumped in. My meta is up 55%. Won’t mention the ones that went the other way though. Msft doing well too. Recently went a little heavy on oil stocks RIG and oxy and slb.

You guys finding any gems?

wildmanyeah

Crew Member

no im bathing in my Facebook winnings

go meta threads lol

go meta threads lol

Rain City

Crew Member

I'm selling everything as it comes even close to par, and throwing it on my variable mortgage hell hole. VSBY being my biggest loss to date with no recovery in sight. Scam central.no im bathing in my Facebook winnings

go meta threads lol

Similar threads

- Replies

- 0

- Views

- 334