You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

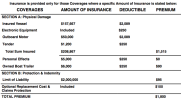

Is this what everyone is paying for insurance

- Thread starter 23Hourston

- Start date

23Hourston

Well-Known Member

Commercials a bit more is it RoyI WISH it was that low ....

BC Coast Pilot

Well-Known Member

I noticed that beacon had me paying 2 mill liability on my 23 hourston. I asked them if the marine liability act limited the claims to 1 million per occurrence, they said yes it does and dropped it to 1 million.

Attachments

searun

Well-Known Member

Seems a tad high on hull and machinery given the low insurable limits. However, premiums are driven by a bit of a hard market right now. Some of the marine underwriters dropped out of the market. A lot of underwriters are limiting their books of business - price is one way to weed out risks they don't really like. Could be related to claim history? Your TPL (legal liability) premium is pretty decent tho. Cheap for $2 mill.

One way to lower your premiums on hull and machinery might be to either tweak your limits lower or pick a higher deductible.

If its any consolation, like Wolf my commercial marine premiums are higher than what you are paying.

One way to lower your premiums on hull and machinery might be to either tweak your limits lower or pick a higher deductible.

If its any consolation, like Wolf my commercial marine premiums are higher than what you are paying.

brutus

Well-Known Member

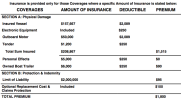

My value is lower then yours, but 843$ a year for 40k value, no fishing gear coverage as it brings it up fast1800 is a bit shocking as I only use the boat 3 to 4 months a years View attachment 79530

23Hourston

Well-Known Member

No claims but it is the only the second year of ensuring a boatSeems a tad high on hull and machinery given the low insurable limits. However, premiums are driven by a bit of a hard market right now. Some of the marine underwriters dropped out of the market. A lot of underwriters are limiting their books of business - price is one way to weed out risks they don't really like. Could be related to claim history? Your TPL (legal liability) premium is pretty decent tho. Cheap for $2 mill.

One way to lower your premiums on hull and machinery might be to either tweak your limits lower or pick a higher deductible.

If its any consolation, like Wolf my commercial marine premiums are higher than what you are paying.

Fisher_dude

Crew Member

That’s what mine is roughly as well through them.$861/ year for full declared value at new $120,000.00.

Sorry.

Portside Marine Insurnace.

walleyes

Crew Member

Yah they got got a guy covered pretty good too, everything I can see I would ever need.That’s what mine is roughly as well through them.

brutus

Well-Known Member

I ain’t no insurance expert but I think where you boat has to do with cost too, some area are known for lots of claims, some not so much, example Albernie inlet, when I use to fish there I had another boat but my insurance was quite a bit more for about same value back then, a friend keep his boat in the inlet and his insurance is around 1600$ for 65k value, he also had a few costly claims over the years

searun

Well-Known Member

Absolutely, claims history is huge factor in premiums based on risk....as is the risk represented by where you are operating and what you are doing. I heard of few guys who had difficulty getting insurance, some underwriters are dumping higher risks in their book of business. These days if you have a smaller claim, probably better to fix it yourself.

walleyes

Crew Member

For sure and offshore makes a big difference. I’m only covered for 22 miles offshore. I have full coverage inside all waters of Puget Sound and Juan de Fuca but not past Cape Flattery which is odd.I ain’t no insurance expert but I think where you boat has to do with cost too, some area are known for lots of claims, some not so much, example Albernie inlet, when I use to fish there I had another boat but my insurance was quite a bit more for about same value back then, a friend keep his boat in the inlet and his insurance is around 1600$ for 65k value, he also had a few costly claims over the years

searun

Well-Known Member

I think this link is a little easier to understand marine limits. The way to look at policy limits is to think about what could happen if you collide with a $500K vessel carrying a group of brain surgeons, injuring everyone on both vessels. The total claim could easily top the $1.5 million liability cap, but also there could be marine environmental damages that are not limited. Ship happens.

tc.canada.ca

tc.canada.ca

Also of note are claims that are not limited:

Marine liability and compensation: Limitation of liability for maritime claims

Limitation of Liability for Maritime Claims

Also of note are claims that are not limited:

Claims that are not limited

The Convention does not limit claims that are:- for oil pollution damageFootnote1

- for nuclear damage

- made by ‘servants’, heirs and dependents, whose duties relate to the ship or the salvage operations

- against the shipowner and relate to raising, removing, destroying or rendering harmless a ship which is:

- sunk

- wrecked

- stranded or abandonedFootnote2

Last edited:

Chasin' Dreams

Well-Known Member

It may help that a close family friend is in management for one of the Canadian insurance underwriter's but trust me, if you don't shop around and insist on getting quote bids from all of the top insurance underwriters then you will be severely ripped off on your insurance. If you just go into an insurance store and ask for insurance, you are dealing with a "broker", not an underwriter. That broker can and will mark up the insurance. That's how they make a living and stay in business. Also do your due diligence in making sure you are covered for things like ensuring you are covered when fishing in certain areas a lot of policies won't cover like fishing off shore away from safe harbor cover, anchorages etc..

Similar threads

- Replies

- 1

- Views

- 783

- Replies

- 16

- Views

- 814