coastalmarinesafety

Active Member

So being in contravention of TC by guiding you are still insured? Very odd!!

I think it's important for commercial operators to know the difference between 1) an insurance agent, who basically sells on behalf of an underwriter and may get a cut of every product they sell, like a car salesmen... and 2) the underwriter investigators, who are specialists at using the fine print to determine if a claim gets paid out or not.

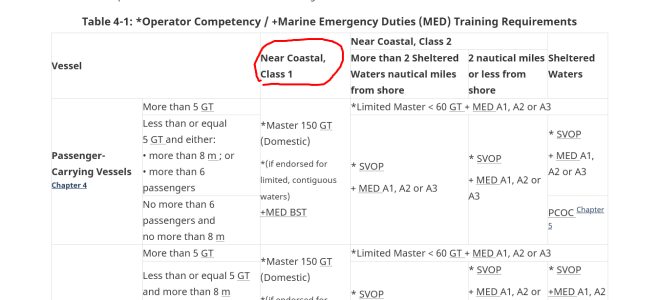

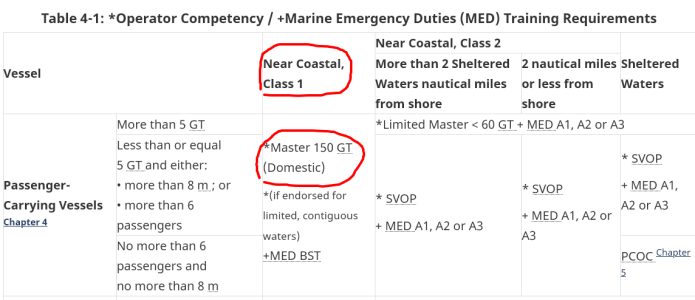

The insurance agent isn't a marine safety regulation expert, as they sell all kids of insurance. The underwriter investigators likely are and know the diffence between pleasure craft regulations and those for passenger carrying vessels. Depends on the fine print of your commercial policy to what extent they would investigate it... for example if you sign off on fine print that says something like "policy owner will comply with all applicable marine safety regulations" in the case of offshore guiding, that means you can't go beyond Near Coastal II (25NM from shore) without some sort of unique certificate with that type of allowance for the operator and the vessel. Also, the TC simplified stability test (one some have done themselves) restricts a small commercial vessel to 25NM from shore, so that may affect some tuna guides as well.

If the 25NM cutoff rule is an impediment to business, as others have said, a guide association or larger sport fishing advocate group would have to represent the guiding community at marine safety advisory meetings with the lawmakers.

It's how the other marine industries (tugs, ferries, commercial fishermen, etc.) get their voice heard with issues that affect their businesses.

Last edited by a moderator: